Complete Guide of Commodity Trading

Item showcasing direct is one of the most seasoned shapes of showcasing known to man. Nowadays, it plays an vital part within the worldwide economy as both an speculation vehicle and a security item. Whether you’re an experienced financial specialist or a amateur, understanding the stock advertise will open the entryways to the budgetary world for you. Enter the world of commodities and learn how they exchange, what decides their value, their dangers and results.

What could be a product?

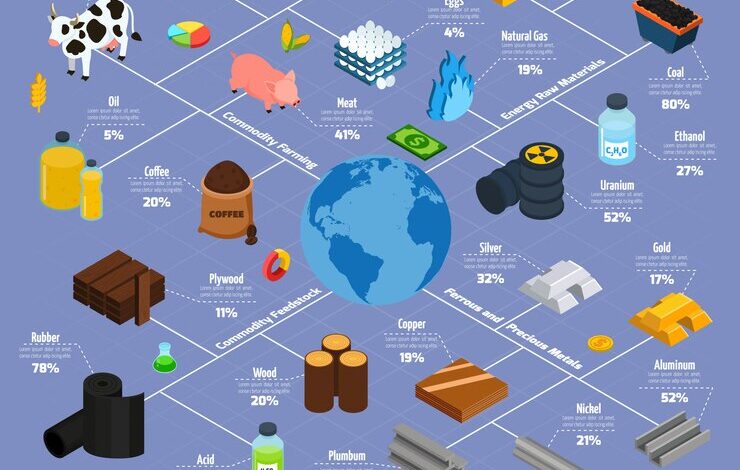

Commodity trading allude to the buying and offering of crude materials or rural items. These commodities incorporate valuable metals such as gold and silver, vitality commodities such as oil and gas, and essential rural commodities such as wheat and coffee. Stocks are exchanged on extraordinary trades and can be obtained in two fundamental shapes: stocks or prospects contracts.

The Significance and Part of Commodities in Worldwide Exchange

Commodities are the establishment of universal exchange. Nations depend on crude materials such as vitality, nourishment, and crude materials to back their financial development. For illustration, oil is capable for transportation, and metals like copper are vital for development and innovation. Through items, nations and businesses can manage the dangers related with cost changes and give themselves with the assets they ought to back development.

A Brief History of Showcasing

Promoting is as ancient as civilization itself. Early shapes of bargain involved the trade of merchandise such as grain, flavors, and animals. Employments were made amid that time. The primary cutting edge trades were set up within the 19th century with the establishing of the Chicago Board of Exchange (CBOT). These trades made standardized contracts that changed the product showcase by making it less demanding and more productive.

Product markets fall into two wide categories:

- Commodities – rural items such as rice, coffee, sugar, and cotton. Materials regularly have regular generation cycles and can be influenced by unusual components such as climate and bothers.

- Commodities – common or extricated assets such as gold, oil, and press mineral. Most items require a critical speculation for me and are frequently related with item advancement.

What is the product like?

Items can be exchanged on an trade, where the item is sold quickly, or on a prospects advertise, where the item will be delivered at a particular time within the future. Prospects exchanging is more prevalent since it permits dealers to hypothesize on cost developments without owning the product. A prospects contract may be a contract that indicates the amount, quality, and conveyance time of a product.

Product Trades: Key Players

Most commodities are exchanged on exchanges, such as the Chicago Commercial Trade (CME) or the Interconversion Trade (ICE). These trades act as mediators, encouraging exchanges between buyers and dealers and guaranteeing that both parties fulfill their commitments beneath the contract.

Beat Commodities Worldwide Markets

A few of the foremost dynamic commodities incorporate:

- Precious Metals: Gold and silver are incredible secure sanctuaries amid retreats.

- Energy: Crude oil, petroleum, and natural gas are imperative to the worldwide transportation and vitality industry.

- Agricultural Products: Wheat, corn, soybeans, and coffee are basic to bolstering the world’s populace.

Why do individuals exchange?

There are numerous reasons why people and institutions lock in in stock exchanging:

- Hedging Against Inflation: Commodities, particularly valuable metals like gold, tend to hold their esteem in reaction to expansion.

- Portfolio Diversification: Stocks are frequently related with stocks and bonds, making a difference you differentiate your portfolio.

- Trading Opportunities: The negative instability of stocks gives speculators with the opportunity to benefit from short-term prices.

Commodity Futures vs. Physical Exchanging

When most individuals think of commodities, they think of buying a barrel of oil or a sack of coffee. In any case, most stocks are comprised of prospects contracts. Prospects permit dealers to guess on the cost of a product without really owning it. This theoretical structure advances liquidity within the showcase, making it less demanding for genuine makers and shoppers to fence against cost chance.

Common Product Costs

Product costs can change based on a number of variables:

- Supply and Demand: A excess or deficiency of a item can cause costs to rise or drop.

- Geopolitical Events: War, sanctions, and other political clashes can have a critical affect on commodities, particularly vitality.

- Currency Fluctuations: Since stocks are for the most part designated within the US dollar, cash changes can influence worldwide markets.

- Weather Conditions: Climate conditions such as drought, floods, and frosts will influence edit yields and thus costs.

Product Exchanging Dangers

Product exchanging is high chance. The foremost imperative of these is price volatility, which can cause huge cost changes due to universal occasions or advertise hypothesis. Dealers too got to oversee their exchanging and risk craving to guarantee they can enter and exit exchanges without causing large losses.

Learn Business Examination:

Get it the nuts and bolts of examination (supply and request investigation) and examination (utilizing charts and chronicled information). Create a Strategy: Decide whether you need a short-term or long-term methodology and what items you need to center on.

Showcasing Stage

Numerous online stages help promote items. A few of the finest choices incorporate MetaTrader 4, Intuitively Brokers, and TD Ameritrade. When choosing a stage, consider components such as cost, the sum of items accessible, and the courses advertised on the platform.

Stocks and ETFs

On the off chance that you need a more comprehensive approach to stocks, you’ll contribute in stock files.