Essential Features for Custom Banking Software and Personal Finance Apps

As digital transformation continues to reshape the financial industry, both custom banking software and personal finance apps are becoming critical tools for modern banks and individual users alike. Developing these solutions with the right features ensures they provide a seamless, user-friendly, and secure experience. This article will explore the essential features that should be included in custom banking software development and personal finance apps to meet user expectations and industry standards.

1. User-Friendly Interface

One of the most critical aspects of both custom banking software and personal finance apps is a user-friendly interface. An intuitive design ensures users can navigate the platform easily, whether they’re accessing banking services or tracking personal finances. The user interface should feature a clean, organized layout with essential functions easily accessible.

Best Practices:

- Incorporate visual elements like graphs and charts to help users understand financial data.

- Include customizable dashboards that allow users to prioritize the information that matters most to them.

- When you build a personal finance app, focus on mobile responsiveness to ensure optimal performance across various devices.

2. Account Management and Synchronization

Account management is a core feature in both custom banking software development and personal finance apps. Users expect the ability to manage multiple accounts seamlessly. Whether it’s a savings account, credit card, or investment account, integration with various financial institutions is necessary.

For banks developing custom software, it’s essential to include features that allow users to:

- View account balances and transaction history.

- Transfer funds between accounts.

- Set up automatic payments and alerts for low balances.

When you build a personal finance app, ensure the app can sync with multiple bank accounts to provide users with a consolidated view of their finances.

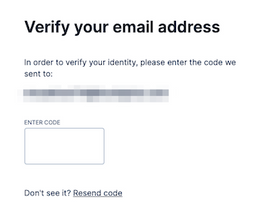

3. Advanced Security Features

Security is a top priority in the financial industry, especially when dealing with sensitive data in banking software and personal finance apps. Implementing advanced security measures during custom banking software development is essential for protecting user data and complying with regulatory requirements.

Key Security Features:

- End-to-End Encryption: Encrypting all data transmissions ensures that sensitive information remains secure.

- Multi-Factor Authentication (MFA): Adding extra layers of authentication, such as biometrics or one-time passwords, increases account security.

- Real-Time Fraud Detection: Incorporate AI-powered systems to detect and prevent fraudulent activities in real time.

When you build a personal finance app, implementing robust security protocols can help build trust and keep users’ financial information safe.

4. Personalized Financial Insights

Today’s users expect more than basic banking services; they want valuable insights into their financial health. Providing personalized financial insights can differentiate your software from competitors.

Incorporate AI and data analytics features into your custom banking software development to deliver insights such as:

- Spending Analysis: Show users how their money is being spent and suggest ways to cut down on expenses.

- Savings Recommendations: Offer tips on increasing savings based on spending patterns.

- Credit Score Monitoring: Provide credit score tracking and recommendations to improve creditworthiness.

When you build a personal finance app, leveraging these insights will help users better manage their money and achieve financial goals.

5. Seamless Integration with Third-Party Services

Modern banking software should allow seamless integration with third-party services to provide users with a complete financial management experience. For instance, integration with payment services like PayPal or investment platforms can add tremendous value.

Integration Capabilities to Consider:

- Payment Gateways: Integrate payment services to allow users to make and receive payments directly through the app.

- Investment Platforms: Offer access to stock trading or crypto investments.

- Budgeting Tools: When you build a personal finance app, include third-party budgeting tools that users may already be familiar with.

Including these integrations during custom banking software development ensures that your software is flexible and meets a wide range of user needs.

6. Real-Time Notifications and Alerts

Keeping users informed about their financial activities in real time is essential for effective financial management. Real-time notifications about transactions, bill payments, low balances, or suspicious activities can significantly improve user experience.

Features to Include:

- Transaction Alerts: Notify users of any deposits, withdrawals, or transfers.

- Payment Reminders: Alert users about upcoming bills or recurring payments.

- Fraud Alerts: Notify users instantly if unusual activity is detected.

By incorporating this feature in custom banking software development, you empower users to stay on top of their financial activities. Similarly, when you build a personal finance app, real-time alerts help users manage their budgets and avoid missed payments.

7. Loan and Credit Management

Loan and credit management features are valuable additions to both custom banking software and personal finance apps. Users can track loan balances, monitor interest rates, and set payment reminders.

For banks developing custom software, it’s beneficial to include options for:

- Applying for Loans: Allow users to apply for personal, auto, or home loans directly within the platform.

- Credit Score Monitoring: Provide users with tools to monitor and improve their credit scores.

When you build a personal finance app, consider adding loan calculators and debt-tracking features to help users manage and pay off their debts effectively.

8. Customer Support Integration

Exceptional customer support can set your app apart in a competitive market. During custom banking software development, consider integrating multiple support options, including:

- Live Chat Support: Allow users to get real-time assistance with their banking needs.

- AI-Powered Chatbots: Automate common queries to provide quick responses.

- Help Centers: Provide comprehensive FAQs and guides for common tasks.

When you build a personal finance app, offering support channels such as live chat or in-app help can significantly enhance user satisfaction.

9. Customizable Budgeting Tools

Budgeting is a key component for anyone looking to manage their finances effectively. Whether you’re focusing on custom banking software or personal finance apps, offering customizable budgeting tools can greatly benefit users.

Features to Include:

- Expense Categorization: Automatically categorize expenses into predefined categories like groceries, rent, or entertainment.

- Custom Budget Settings: Allow users to set monthly or weekly budgets for different categories.

- Spending Insights: Provide visual reports showing how close users are to reaching their budget limits.

Implementing these tools when you build a personal finance app helps users take control of their spending and achieve financial goals.

10. Multi-Currency Support

For users with international financial needs, multi-currency support is a crucial feature. When planning custom banking software development, ensure your software can handle multiple currencies for international transactions.

Key Considerations:

- Currency Conversion: Provide real-time exchange rate updates for users.

- Foreign Accounts Management: Allow users to manage accounts in different currencies.

When you build a personal finance app, multi-currency support can be a valuable feature for users who frequently travel or manage international finances.

11. Investment and Wealth Management Tools

Many users look for software that goes beyond basic banking to help them grow their wealth. Including investment and wealth management tools can make your platform more comprehensive.

Features to Integrate:

- Portfolio Tracking: Allow users to track investments such as stocks, bonds, or cryptocurrencies.

- Robo-Advisors: Implement automated financial advisors that can suggest investments based on user preferences.

- Financial Planning: Offer tools to help users set and achieve long-term financial goals.

By incorporating these features in custom banking software development, you provide a holistic financial management solution. Similarly, when you build a personal finance app, offering investment tools can attract a broader user base.

Conclusion

Incorporating the right features in custom banking software development and when you build a personal finance app is essential for providing value and meeting user expectations. From user-friendly interfaces and advanced security features to personalized insights and investment tools, the essential features discussed in this article will help create a comprehensive financial management platform. By addressing the needs of both banking institutions and individual users, these features can differentiate your software in a competitive market.