LTCC and HTCC Market Analysis (2024-2032)

In recent years, the demand for advanced ceramics has surged across multiple industries, positioning Low-Temperature Co-fired Ceramics (LTCC) and High-Temperature Co-fired Ceramics (HTCC) at the forefront of technological innovation. The global LTCC market and HTCC market size attained a value of USD 1,077.38 million in 2023. The industry is further expected to grow at a CAGR of 4.5% in the forecast period of 2024-2032, reaching a value of USD 1,605.30 million by 2032. This post aims to delve into the factors driving this growth, the market dynamics at play, and the segmentation analysis that highlights the diverse applications and opportunities within these markets.

Market Overview

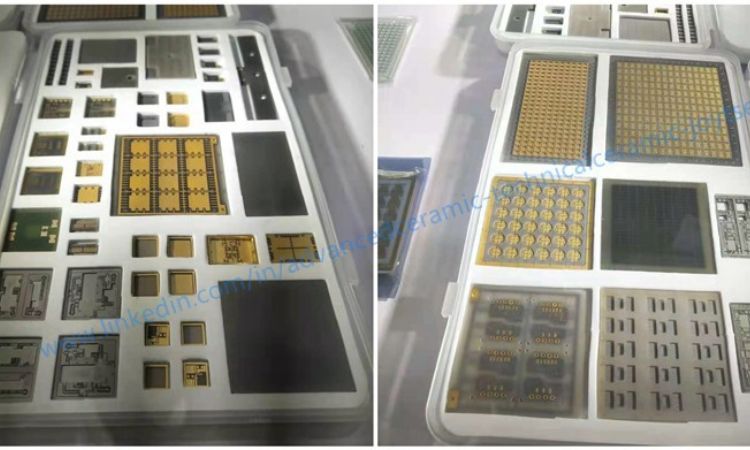

LTCC and HTCC technologies are renowned for their ability to create complex electronic circuits in a compact form. LTCC is generally used in applications that require low firing temperatures, making it ideal for multilayer circuits, while HTCC operates at higher temperatures and is suitable for high-performance applications. These technologies are particularly valued for their thermal stability, mechanical strength, and electrical performance, allowing them to excel in various industries, including automotive, telecommunications, aerospace, and medical sectors.

Market Size and Forecast

The global LTCC and HTCC markets have demonstrated significant growth, fueled by increasing demand for miniaturized electronic components and high-performance materials. As mentioned, the market was valued at USD 1,077.38 million in 2023, with projections suggesting a robust CAGR of 4.5% through 2032. This growth is largely attributed to the rising need for advanced ceramics in diverse applications, driven by ongoing technological advancements and the increasing complexity of electronic devices.

Market Growth Drivers

Several factors are propelling the growth of the LTCC and HTCC markets:

- Technological Advancements: Innovations in ceramic materials have led to enhanced performance characteristics, making LTCC and HTCC suitable for more demanding applications. The development of new formulations and processes has broadened their applicability across industries.

- Automotive Sector: The automotive industry’s shift towards electrification and the integration of advanced electronics in vehicles has significantly boosted the demand for LTCC and HTCC. These ceramics are essential for manufacturing sensors and modules that contribute to vehicle safety and efficiency.

- Telecommunications: With the expansion of 5G networks, the telecommunications sector is increasingly relying on LTCC and HTCC technologies for high-frequency devices and communication systems. Their ability to handle high frequencies and integrate multiple functions into a single package makes them invaluable.

Market Challenges

Despite the promising growth, the LTCC and HTCC markets face several challenges:

- Supply Chain Issues: Fluctuations in the availability of raw materials can impact production schedules and pricing. Companies must navigate these challenges to maintain competitiveness.

- Competition from Alternative Materials: Emerging materials and technologies pose a threat to the traditional ceramic markets. Companies must continue to innovate to stay relevant and meet the evolving needs of customers.

Segmentation Analysis

A comprehensive understanding of the LTCC and HTCC markets requires an analysis of their various segments.

By Process Type

- LTCC: This segment is anticipated to dominate the market due to its versatility and suitability for low-temperature applications. LTCC technology is particularly effective for multilayered circuits, which are essential in consumer electronics and automotive applications.

- HTCC: Though smaller in comparison, the HTCC segment is gaining traction, especially in high-temperature applications such as aerospace and defense, where reliability and performance are critical.

By Material Type

- Glass Ceramic Material: This type of material is favored for its thermal stability and electrical insulation properties, making it ideal for telecommunications and automotive applications.

- Ceramic Material: Traditional ceramics remain essential for a wide range of applications due to their durability and cost-effectiveness. Their continued use across industries underscores their importance in the LTCC and HTCC markets.

By End Use

- Automotive: The growing integration of advanced electronic systems in vehicles has significantly increased the demand for LTCC and HTCC technologies. Applications include sensors, actuators, and control modules.

- Telecommunication: The need for high-frequency, reliable communication devices drives the demand for LTCC and HTCC in the telecommunications sector, particularly with the rollout of 5G.

- Aerospace and Defense: High-performance ceramics are crucial for applications requiring thermal and mechanical resilience, making LTCC and HTCC indispensable in this sector.

- Medical: The healthcare industry utilizes these ceramics for diagnostic devices and implants, benefiting from their biocompatibility and reliability.

- Other Applications: Emerging sectors, including renewable energy and IoT devices, present new opportunities for growth in the LTCC and HTCC markets.

Regional Analysis

Geographical dynamics play a significant role in shaping the LTCC and HTCC markets. Key regions include:

- North America: The region remains a leader in technological innovation and is witnessing significant growth in the automotive and telecommunications sectors.

- Europe: Known for its strong automotive industry, Europe is investing heavily in advanced materials, bolstering the demand for LTCC and HTCC.

- Asia-Pacific: Rapid industrialization and a booming electronics market make this region a hotbed for LTCC and HTCC growth, particularly in China and Japan.

- Latin America and Middle East & Africa: These regions are gradually embracing advanced ceramics, with increasing investments in technology and infrastructure.

Market Dynamics

SWOT Analysis

A SWOT analysis provides insights into the strengths, weaknesses, opportunities, and threats within the LTCC and HTCC markets:

- Strengths: High-performance characteristics and versatility across applications are key strengths of LTCC and HTCC technologies.

- Weaknesses: Production complexity and reliance on raw materials can pose challenges for manufacturers.

- Opportunities: Emerging markets and new applications, particularly in renewable energy and smart technologies, present significant growth opportunities.

- Threats: Economic fluctuations and competition from alternative materials may impact market stability.

Competitive Landscape

The competitive landscape of the LTCC and HTCC markets is characterized by several key players who are investing in R&D to innovate and enhance their product offerings. Companies like Murata Manufacturing, NGK Spark Plug, and Kyocera are notable leaders, each contributing to advancements in material science and manufacturing processes.

Recent developments, including strategic partnerships and acquisitions, further highlight the competitive nature of these markets. Companies are increasingly focusing on sustainable practices and environmentally friendly materials to meet evolving consumer demands.